Next, identify the items you wish to donate and record their conditions. Below is a donation value guide of what items generally sell for at goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price. To help guide you, goodwill has compiled a list providing price ranges for items commonly sold in goodwill stores. Assume the following items are in good condition, and remember, prices are.

To determine the fair market value of an item not on this list, use 30% of the item’s original price. To help guide you, goodwill has compiled a list providing price ranges for items commonly sold in goodwill stores. Assume the following items are in good condition, and remember, prices are. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Guide for goodwill donors to estimate the value of their donation. Often requested by goods donors for tax purposes. This is merely a guideline to assist you in determining values for your. To help you determine your donations fair market value goodwill is happy to provide a “value guide” that offers average prices in our stores for items in good condition. Assume the following items are in good condition, and remember—prices are only estimates.

Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Guide for goodwill donors to estimate the value of their donation. Often requested by goods donors for tax purposes. This is merely a guideline to assist you in determining values for your. To help you determine your donations fair market value goodwill is happy to provide a “value guide” that offers average prices in our stores for items in good condition. Assume the following items are in good condition, and remember—prices are only estimates. Oct 13, 2023 · monly donated items. For instance, a men’s overcoat could be valued anywhere from $10 to $60, while a coffee maker might. Ange from $4 to $15. Please note that these. Internal revenue service (irs) requires donors to value their items.

Guide for goodwill donors to estimate the value of their donation. Often requested by goods donors for tax purposes. This is merely a guideline to assist you in determining values for your. To help you determine your donations fair market value goodwill is happy to provide a “value guide” that offers average prices in our stores for items in good condition. Assume the following items are in good condition, and remember—prices are only estimates. Oct 13, 2023 · monly donated items. For instance, a men’s overcoat could be valued anywhere from $10 to $60, while a coffee maker might. Ange from $4 to $15. Please note that these. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Below is merely a guideline to assist you in determining values for your own items. You must take into consideration the quality and condition of your items when determining a value.

Often requested by goods donors for tax purposes. This is merely a guideline to assist you in determining values for your. To help you determine your donations fair market value goodwill is happy to provide a “value guide” that offers average prices in our stores for items in good condition. Assume the following items are in good condition, and remember—prices are only estimates. Oct 13, 2023 · monly donated items. For instance, a men’s overcoat could be valued anywhere from $10 to $60, while a coffee maker might. Ange from $4 to $15. Please note that these. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Below is merely a guideline to assist you in determining values for your own items. You must take into consideration the quality and condition of your items when determining a value.

Please note that these. Internal revenue service (irs) requires donors to value their items. To help guide you, goodwill industries international has compiled a list providing price ranges for items commonly. Below is merely a guideline to assist you in determining values for your own items. You must take into consideration the quality and condition of your items when determining a value.

You must take into consideration the quality and condition of your items when determining a value.

Stop Job Hunting, Start Job Landing: Your Employability Skills Worksheet

18 Printable Templates: Write The PERFECT Performance Review

The Most Effective ESL Passive Voice Worksheets Ever Created? (Probably)

Your Electrical Panel Needs These Labels (Free Templates!)

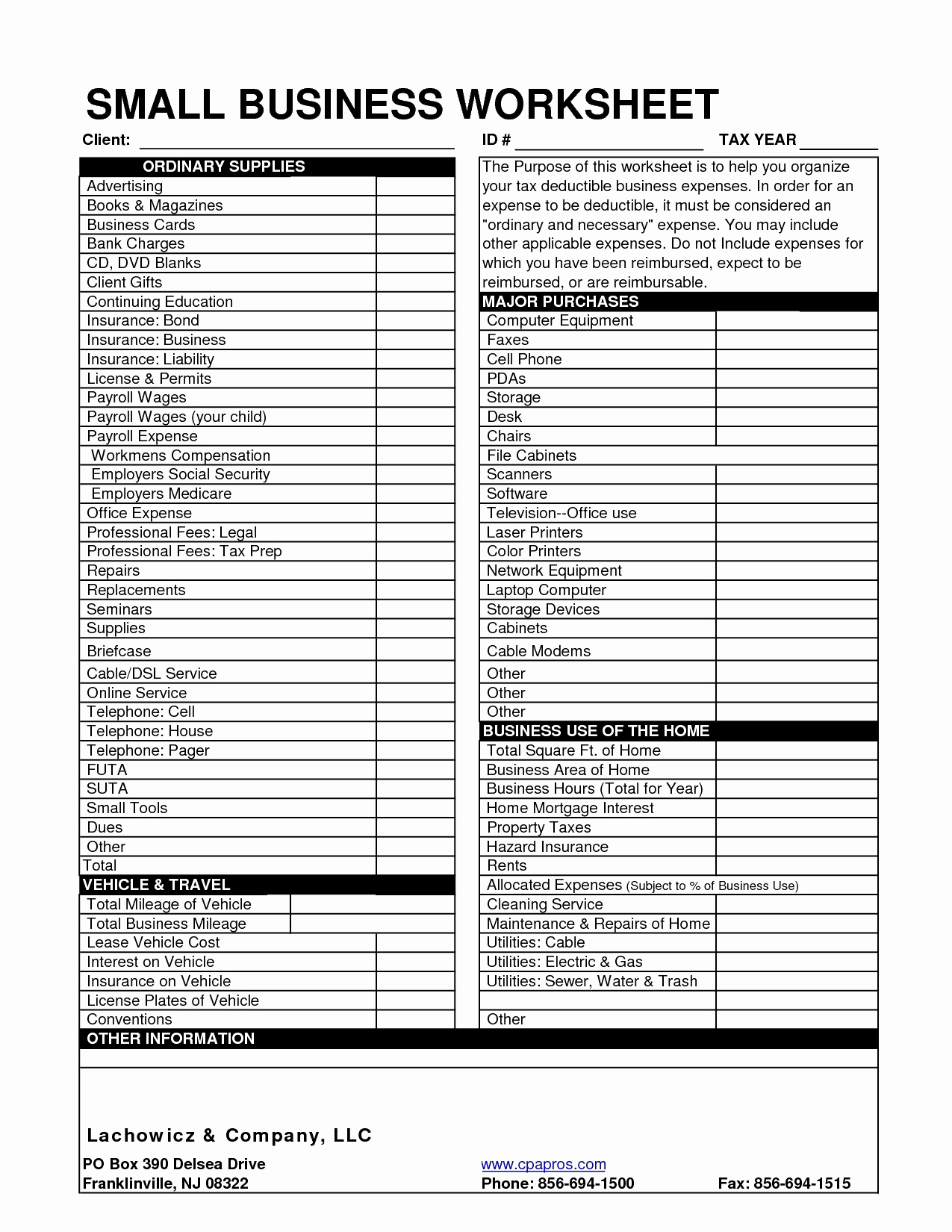

Stop Wasting Time! Get Your Tax Intake Form Template NOW